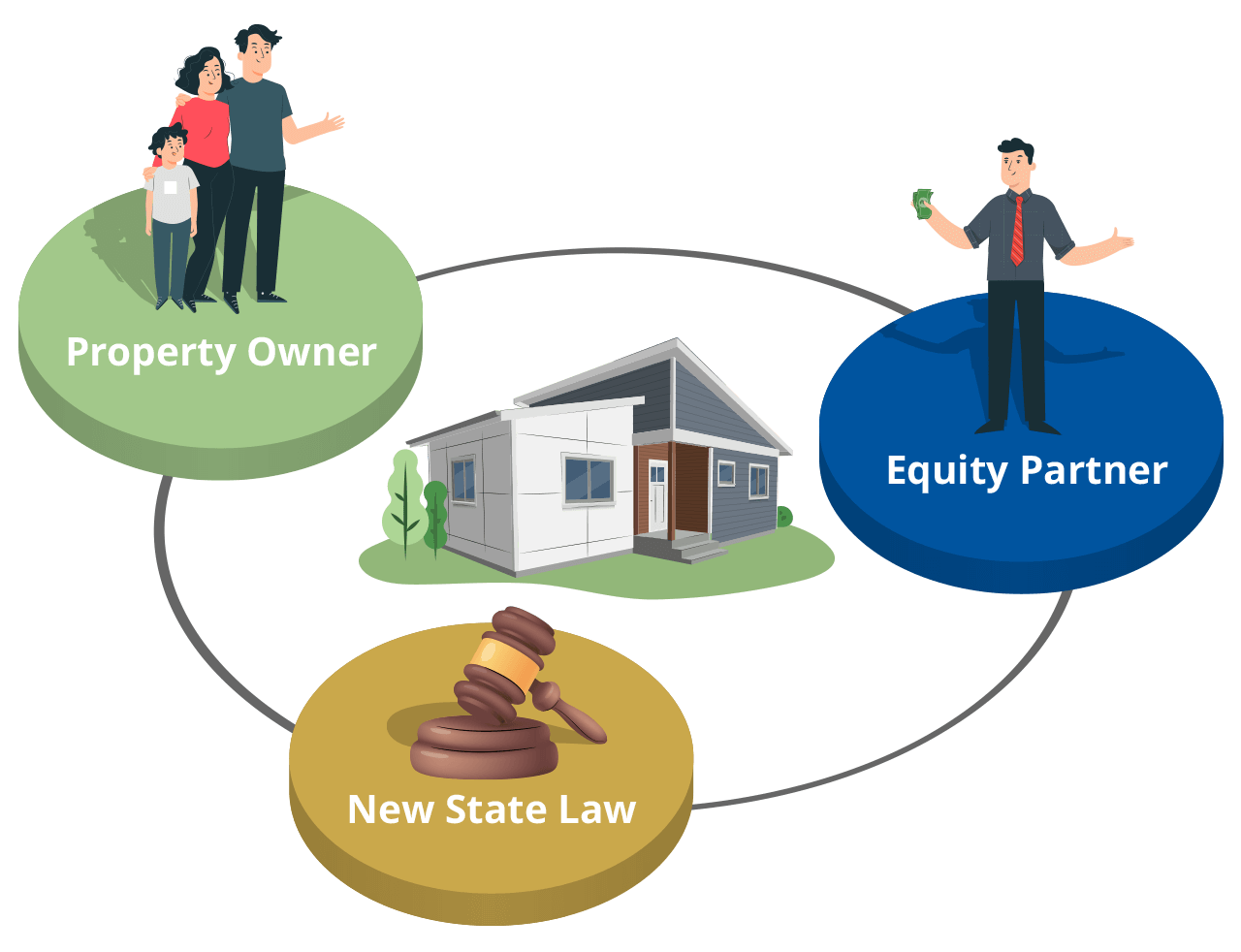

Equity Partner

Quiz – True or False?

You like to take part in “Solving the Housing Crisis One DADU at a Time.”

You are interested in creating a new passive income stream.

You have over US$200,000 in capital to invest.

You don’t need to ask others to come up with the capital.

You see rental properties as safer assets than stocks.

You believe DADUs will appreciate over time.

You’re not a builder or rental property manager.

You don’t know how to legally condominiumize a property and set up the HOA.

You understand that there is risk involved (it’s possible to lose money) in any investment including SkyDADU.

If you answered True…

Then congratulations!

You can be a great Equity Partner for SkyDADU.

SkyDADU is a one-stop-shop for all things DADU. We finance, build and manage DADUs all under the same umbrella.

The biggest benefit of becoming a SkyDADU Equity Partner is that you become a real estate investor without purchasing land to create a passive income stream from the rent, cash in on the sales proceeds by selling the DADU [with the stipulation that a partial reconveyance of title is approved by the first position deed holder of the Property Owner’s mortgage if s/he has one]. Another great thing about being a SkyDADU Equity Partner is that you have a right of first refusal for the DADU when it’s time to sell. That means the DADU could potentially become a legacy for your children or grandchildren in the future.

Example – Sam, the Equity Partner:

Cash-on-Cash Return (CoCR)

Cash-on-Cash Return (CoCR) for Equity Partner:

CoCR is a key metric used in real estate investment to measure the annual return on the cash invested in a property. This metric provides you, the Equity Partner, with a clear picture of your equity financing’s profitability relative to your initial cash outlay. It helps you understand how much cash flow you can expect to receive as a percentage of your cash investment, making it a straightforward tool for assessing whether becoming an Equity Partner through SkyDADU is a better option than other investment assets or not.

Example – Sam, the Equity Partner:

- Total DADU Construction Cost: $380,000

- Sam’s Investment: $190,000 (50% equity) + $5,700 (SkyDADU origination fee of 3%) = $195,700

- Projected Rental Income:

- Monthly Rent: $4,000 – $500 (Projected Property Tax, Insurance and HOA Fee) = $3,500

- Annual Rental Income: $42,000

- Sam’s Share of Rental Income:

- Since, the Property Owner in this case, invested the minimum requirement of 50%, Sam receives 50% of the rental income:

- Sam’s Projected Annual Rental Income: $21,000

- Cash-on-Cash Return (COCR):

- COCR = $21,000 ÷ $195,700 = 10.7%

In this example, Sam earns a Cash-on-Cash Return of 10.7% annually. Of course, the rent may not remain at $4,000 per month during the 10-year SkyDADU contract duration so the CoCR can vary based on the rental market conditions.

Return On Investment (ROI)

Return On Investment (ROI) for Sam in 10 years:

ROI in real estate measures the profitability of an investment by comparing the net profit to the initial cost plus other costs incurred over the 10-year period (such as maintenance & repairs beyond the HOA requirements, listing agent fee (2.5%),and the ECT [End-of-Contract Transfer] Fee at 1%).

- Total (Assumed) DADU Maintenance & Repair Cost Over 10 Years:

$10,000 including WSST - Sam’s Total Investment Cost over the 10 Years:

$195,700 + ($10,000 ÷ 2) = $200,700 - DADU Projected Listing Price (Assuming $400,000 as the Baseline Value with Bellevue’s Average Appreciation [Source: neighborhoodscout.com] of 74.6% over 10 Years): $698,400

- Listing Agent Fee (2.5%): $17,460

- ECT (1%): $6,984

- Sam’s Total Rental Income in 10 Years (Assuming the $4,000/month rent remained as-is): $210,000

- Projected Net Profit for Sam (Sam kept the 50% Equity Position for the 10 Years):

$210,000 + [($698,400 – $17,460 – $6,984) x 50%] – $200,700 = $346,278 - Projected ROI for Sam: ($346,278 ÷ $200,700)*100 = 172.5%

In this example, Sam , projected not guaranteed, a 172.5% ROI in 10 years. The actual CoCR and ROI numbers may even be higher because the lack of affordable housing / rental units is expected to persist for the next decade and beyond. (*NOTE: The numbers above are intended for illustration purposes only. The actual numbers may vary due to taxes and other transactional costs which are not accounted for in these numbers.)

What's the Next Step?

From feasibility to the last nail, our experts will help turn your DADU vision into reality. Let's get Started!

Already have the necessary funds to build your DADU?

Please contact Sockeye Homes so that you can get started with the Design-Build process.

Ready to get started or have questions?

Call Us

(253) 737-4456

Email Us

Using our easy contact form